KGI Bought a Minority Stake in Wiener Private Bank

Krupa Global Investments (KGI) bought small stake in Wiener Private…

Krupa Global Investments (“KGI”) is one of the largest shareholders of GAM Holding AG. Currently holding nearly 3% stake in shares, options and CFDs.

KGI is supporting statement of CEO Sanderson that GAM is not talking about merger with anybody at this point. Media speculations showed that Generali, Italy’s biggest insurer has made comments that Generali is willing to spend €3bln for acquisitions in insurance and asset management space, GAM was one of the targets.

Based on our meeting with CFO McNamara, we believe that GAM management with new CEO Sanderson will increase profitability significantly within next few quarters, so we don’t see pressure to force GAM up for sale at this price as relevant. GAM shares are undervalued which we would like to support by valuation described here.

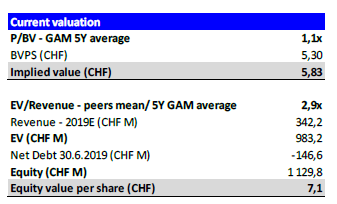

Over the past 5 years, GAM shares have traded at an average of 1.1x the book value, which is higher than the current 0.8x. Comparable companies are currently trading for 2.6x BV, a level that GAM has never reached in the five-year period under review, so we will use an average GAM multiple of 1.1x for the valuation.

In the case of the second multiple of EV / Revenue, the five-year average of GAM (2.8x) is virtually the same as that of comparable firms (2.9x), so we will use the sector average. GAM is currently trading below this level (1.7x).

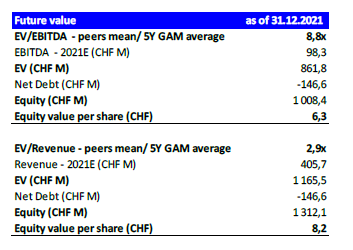

Based on future value, comparable companies are trading at 8.8x EV / EBITDA, which is exactly the same as the five-year average of GAM, so we will use this amount. We will use the net state to reflect the level of debt as of June 30 2019, because in subsequent periods we do not expect any significant changes in this figure.

The intrinsic value of

GAM’s shares is in the range of 6.3 CHF to 8.2 CHF due to improved performance

in 2021, which represents growth potential against the current market value by

more than 100%. (See table below)

If there will be relevant merger offer for GAM in future, KGI would fight and stand on behalf of shareholders and don’t allow low-ball offers to be accepted by management.

Krupa Global Investments (KGI) bought small stake in Wiener Private…

Krupa Global Investments a.s., České Lithium a.s. and partners (‘’Offeror’’)…

Krupa Global Investments a.s., České Lithium a.s. (Czech Lithium) and…